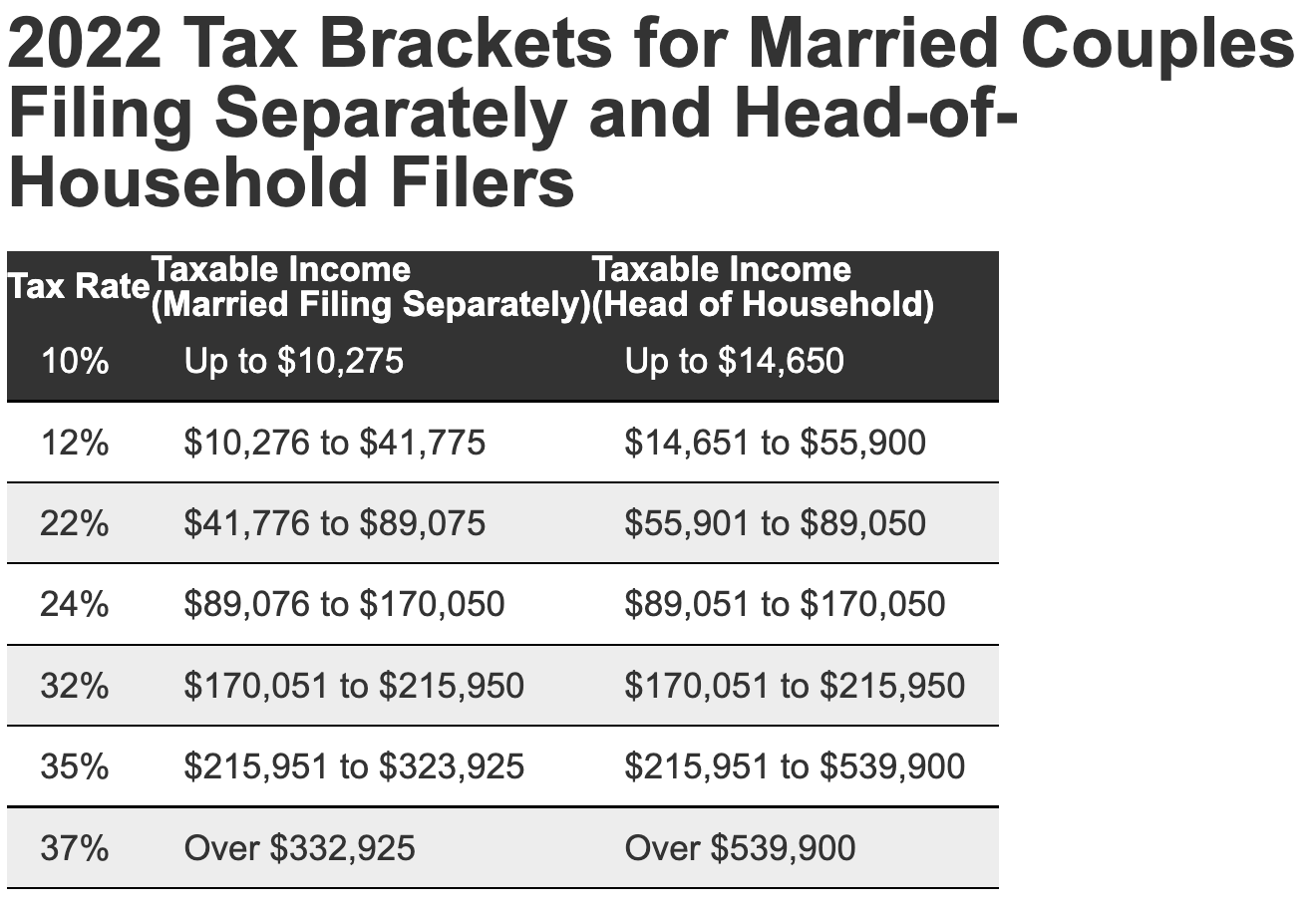

The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2022 tax year, which are the taxes due in early 2023. minimum tax is calculated as a percentage of your federal minimum tax and is currently 33.7%. Income falling within a specific bracket is taxed at the rate for that bracket. If you're subject to minimum tax under the federal Income Tax Act, you're also subject to B.C. 2022 Tax Table.pdf (219.83 KB) 2022 Georgia Tax Rate Schedule. It is recommended to use the tax rate schedule for the exact amount of tax. The Patient Protection and Affordable Care Act added an. Note: The tax table is not exact and may cause the amounts on the return to be changed. The American Taxpayer Relief Act of 2012 increased the highest income tax rate to 39.6 percent. What are marginal tax rates A common misconception is that if your taxable income moves to a higher tax bracket, your entire income will be taxed at that higher rate.

Tax rates are applied on a cumulative basis. Personal income tax brackets and rates - 2023 tax year Taxable Income - 2023 Brackets

2022 INCOME TAX BRACKETS PLUS

You are free to copy, adapt, modify, transmit and distribute this material as you wish (but not in any way that suggests the ATO or the Commonwealth endorses you or any of your services or products).For the 2023 tax year, the tax brackets were increased from the previous year by a BC CPI rate of 6.0%. US Tax Brackets for Single 2021 12, 9,950 to 40,525, 987.50 plus 12 of the amount over 9,950 22, 40,525 to 86,375, 4,664 plus 22 of the amount. © Australian Taxation Office for the Commonwealth of Australia Seven tax brackets exist for the 2021 tax year or taxes due in April 2022 or October 2022, with an extension. The income ranges for each tax bracket vary by filing status. Connecticut income tax has seven tax brackets with rates ranging from 3.00 to 6.99. This report updates OLR Report 2020-R-0191.

2022 INCOME TAX BRACKETS PROFESSIONAL

If you feel that our information does not fully cover your circumstances, or you are unsure how it applies to you, contact us or seek professional advice. exemptions, credit amounts, and thresholds in effect for the 20 tax years. For example, one of the requirements for the parental election is that a child's gross income is more than the amount referenced in 1(g)(4)(A)(ii)(I) but less than 10 times that amount thus, a child's gross income for 2022 must be more than 1,150 but less than 11,500.03 Maximum. Make sure you have the information for the right year before making decisions based on that information. parent's gross income and to calculate the 'kiddie tax'). Some of the information on this website applies to a specific financial year. If you follow our information and it turns out to be incorrect, or it is misleading and you make a mistake as a result, we will take that into account when determining what action, if any, we should take.

We are committed to providing you with accurate, consistent and clear information to help you understand your rights and entitlements and meet your obligations.

0 kommentar(er)

0 kommentar(er)